Capital Growth vs Rental Yield: Which Strategy Should You Choose?

Table of Contents

ToggleTrying to decide where to invest in Melbourne's property market?

If you’re considering buying an investment property, one big question is likely sitting at the front of your mind.

Should you go for capital growth or rental yield?

In simple terms:

- Capital growth is when your property’s value increases over time

- Rental yield is the income you earn from tenants, usually weekly or monthly

Both sound good, but depending on your goals, one may suit you better than the other.

At The Realta, as the most trusted Property search agent in Melbourne, we help people invest smarter using real data, local insights and the right strategy.

Capital Growth: Letting Time Grow Your Investment

Capital growth is all about long-term gain. You buy a property today, and in five or ten years, you aim to sell it for more than you paid.

Let’s say you buy in a high-growth area for $700,000. Ten years later, it’s worth $1.1 million. That increase in value is capital growth.

Tools like a Real estate growth calculator in Melbourne are designed to help you forecast how much your property could be worth in the future. These tools factor in average growth rates, suburb performance and more, making them a great first step.

Best for: People with a long-term plan

Great areas: Established suburbs and gentrifying areas in Melbourne

What to use: Try a real estate growth calculator to see what your money could become

Rental Yield: Creating Income from Day One

Rental yield is the income your property generates from tenants. It’s usually calculated as a percentage of the property’s value.

For example, if your $500,000 property brings in $500 a week in rent, your gross yield is 5.2%. From there, you’d subtract any running costs to calculate your net yield.

If you’re an investor looking for consistent income or planning to build a rental portfolio, this strategy might be right for you. A property growth calculator in Melbourne can also help estimate yield potential, taking into account rent prices in your chosen suburb.

Best for: Income-focused investors

Best locations: Outer suburbs and high-rent areas

What to use: Use a property growth calculator to check yield potential before you buy

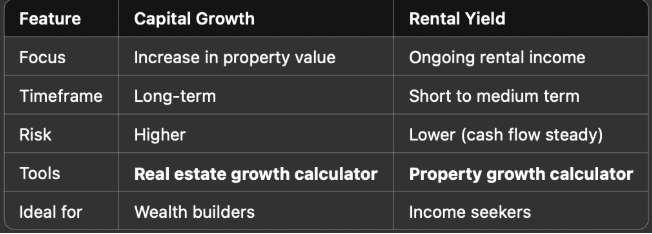

Capital Growth vs Rental Yield – A Simple Comparison

The right approach depends on your financial goals. That’s why our team of real property buyers in Melbourne always begins by understanding what’s most important to you.

Can You Combine Both Strategies?

Yes, and many investors do. You can aim for a property that offers both steady rental income and future capital growth. This might mean choosing a location with consistent rental demand while also being in a growth corridor. Some properties tick both boxes.

One proven approach that demonstrates this balanced strategy in action is the granny flat method, which can significantly boost both your rental income and property equity simultaneously. Watch our detailed breakdown of how this strategy works in our discussion with Tim Austin, Managing Director of Affordable Modular Buildings and the real returns it can generate for Melbourne investors.

With help from a skilled Property buying agency in Melbourne, you can find the right balance that suits your goals, budget and risk profile.

Need Help Choosing the Right Strategy?

Ask yourself:

- Do I need income now, or am I happy to wait for future value?

- Am I more comfortable with steady returns or long-term rewards?

- Do I understand the risks of each option?

If you’re unsure, use a real estate growth calculator to map out projections or chat with our team. As experienced property search agents in Melbourne, we’ll help you understand what suits your lifestyle and future plans.

Need help planning your next property move?

Get in touch with The Realta – Property Buyer’s Agency, a trusted property buying agency in Melbourne, helping investors, first-home buyers, and families make confident property decisions across Melbourne.

Why Buyers Trust The Realta

At The Realta – Property Buyer’s Agency, we don’t just help you find a property. We help you make the right decision. Our team combines deep local knowledge with data-driven tools like our real estate growth calculator in Melbourne, so you can feel confident at every stage.

Whether you’re looking for strong capital growth, reliable rental yield, or a strategy that balances both, we work with you to understand your goals and find the best path forward.

As experienced real property buyers in Melbourne, we simplify the complex. From identifying off-market opportunities to negotiating the best terms, our approach is personal, professional, and built around your success.

When you choose The Realta – Property Buyer’s Agency, you’re not just buying a property; you’re investing with clarity, strategy, and expert support behind every step.

Conclusion: Choose Based on Your Goals, Not Just the Market

There’s no single answer. Some investors need income now. Others want to grow long-term wealth. In the end, the best strategy is the one that works for you, and The Realta – Property Buyer’s Agency is here to help you find it.

Let us help you make an informed choice using smart tools like our real estate growth calculator in Melbourne, expert negotiation, and genuine local insight.

WE HELP IN

Get in Touch

Ready to take the next step? Contact The Realta – Property Buyer’s Agency today as your expert property-buying agency in Melbourne and start your investment journey with clarity and confidence.

Gurminder Singh is the Head of Research, Co-Founder, and Buyer’s Agent at The Realta – Property Buyer’s Agency. He brings deep industry expertise backed by a Master’s degree in Management and years of real estate experience. Known for his data-driven approach and sharp financial insight, Gurminder helps clients make strategic property decisions—whether buying, selling, or investing. With strong sales acumen and a proven track record in building a multi-million-dollar property portfolio, he excels at sourcing high-performing properties tailored to each client’s goals.